Budgeting apps: free, for couples, for students

If you've been planning on taking care of your personal finances and starting to control them for a long time, it's time to install a budgeting app. This way you will keep track of your spending, plan your monthly budget and finally figure out where your money flows each month. Read on to discover the 7 best budgeting apps and stay financially stable.

CoinKeeper

For smart savings

CoinKeeper is the easiest and most user-friendly app for financial debutants who have just stepped on the thorny way to saving money. By using built-in graphs, charts, and categories you can track all your spending and earnings, discover and analyze where the money goes, hence how to spend less and increase your wealth. The only thing you will have to do is to be disciplined and write down all your expenses every day to keep track of them.

You can download the CoinKeeper app for Android here and here for iOS devices.

You Need a Budget

Track your progress in making savings

You Need a Budget is an app designed more as a helpful tutorial or course for those of you who can not manage to save money and live from paycheck to paycheck. The app helps organize your finances, set and reach savings goals and see your progress in graphs and charts. You can sync your credit and debit cards with YNAB app and learn how to save money with your own example. The service is also available in a desktop version.

You can download You Need a Budget for Android here and here for iOS devices.

Clarity Money

Synchs all your bank accounts

If you are subscribed to multiple services, and can not even remember some of them, the money tracking app Clarity Money has a feature that finds all of your subscriptions so you can monitor or cancel them. You can also sync your bank accounts and keep track of all your credit and debit cards, investments, loans, and income. By analyzing your whole financial picture you are likely to decide to lower your expenses and open a high-yield savings account. As they say: a penny saved is a penny earned!

You can download ClarityMoney for Android here and here for iOS devices.

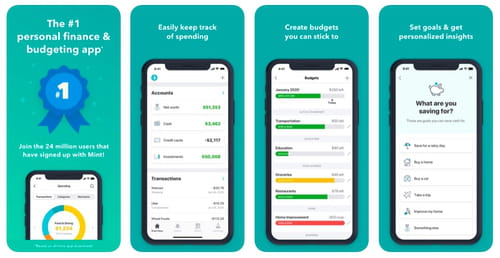

Mint

Track your spending by categories

Mint is a handy app that you can link to your debit or credit card and see the categories on which you spend most of your monthly budget. You can also set up spending limits to never exceed your financial threshold and control your cash flow. The possibility to monitor your credit score and track your bills is also a useful feature that you can hook up to get the most out of the app.

You can download Mint for Android here and here for iOS devices.

PocketGuard

Check how much money you spend daily/weekly/monthly

The best app to manage your everyday spending. PocketGuard literally looks after your wallet and shows you exactly how much money you can spend each day, week, or month after all your mandatory payments such as credits, phone bills, rent, etc. You can also set up your savings goals and upgrade your economy skills.

You can download PocketGuard for Android here and here for iOS devices.

Goodbudget

Set the limit and don't exceed it

Goodbudget offers a convenient financial fragmentation system such as envelopes meaning that you divide all your spending by categories and manage each one of them to not exceed your limits. The app has different subscription plans including a family one where you can share a budget with your partner. The one and only disadvantage is that you can’t sync your bank account balances, you can only add them manually.

You can download Goodbudget for Android here and here for iOS devices.

Wally

Link your accounts (even foreign ones) and keep track of your financial succes

If you don’t need any additional features but just the ability to control your spendings, Wally might be the solution. You can sync your different bank accounts, even your foreign accounts, track all your transactions, divide your monthly budget into various categories such as eating out, groceries, travel, entertainment, etc and track your progress in savings.

You can download Wally for iPhone here.